Industry news

Is “Made in China” Losing Competitiveness in the U.S. Textile and Apparel Market

Before ending of China's Reform and Opening forty years anniversary, we can’t help thinking the question that if Made-in-China is losing its competitiveness in U.S. market.

Answer is definitely negative. People always mention Vietnam, Bangladesh or India when raising of opinion, however, statistics tell the truth and nobody can deny it.

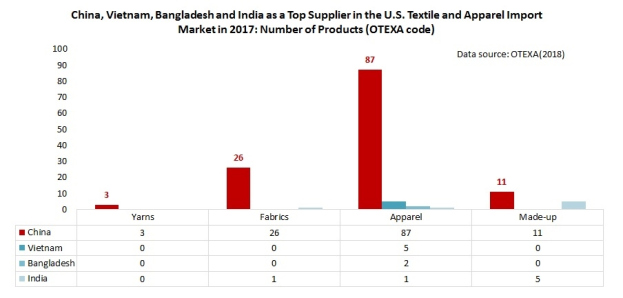

A fact-checking review of trade statistics in 2017 of a total 167 categories of textile and apparel (T&A) products categorized by the Office of Textiles and Apparel (OTEXA) suggests that T&A products “Made in China” still have no near competitors in the U.S. import market.

Generally, China domains and far ahead of those often referred competitors.

-Vietnam was the top supplier for only 5 categories of apparel (less than 5% of the total);

-Bangladesh was the top supplier for only 2 categories of apparel (less than 2% of the total);

-India was the top supplier for 1 category of fabric (2.9% of the total), 1 category of apparel (1% of the total) and 5 categories of made-up textiles (41.7% of the total).

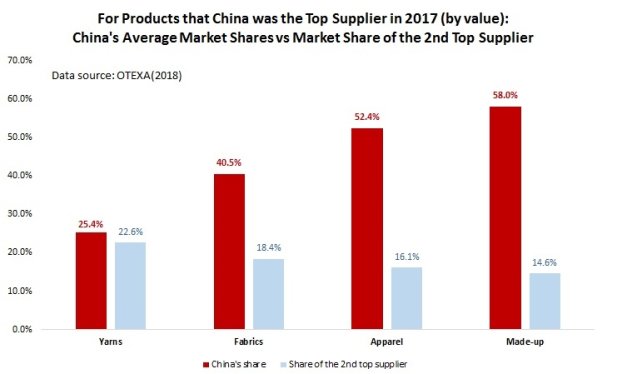

Notably, China was not only the top supplier for many T&A products but also held a lion’s market shares.

For the 26 categories of fabric that China

was the top supplier, China’s average market shares reached 40.5%, 22

percentage points higher than the 2nd top suppliers for these categories

For the 87 categories of apparel that China

was the top supplier, China’s average market shares reached 52.4%, 36

percentage points higher than the 2nd top suppliers for these categories.

For the 11 categories of made-up textiles

that China was the top supplier, China’s average market shares reached 58%, 43

percentage points higher than the 2nd top suppliers for these categories.

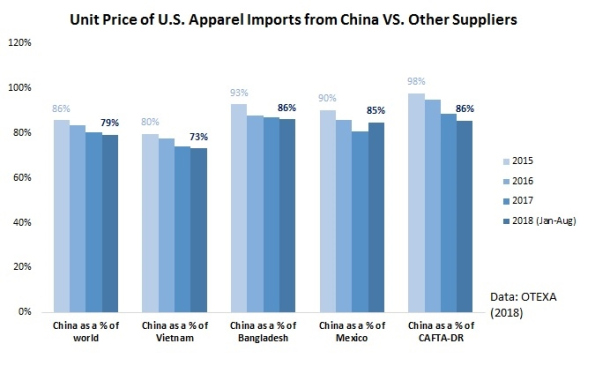

Furthermore, T&A “Made in China” are demonstrating even bigger price competitiveness compared to other suppliers in the U.S. market. For example, in 2017, the unit price of apparel “Made China” was only 74% of the price of “Made in Vietnam” (in 2015 was 80%), 86% of “Made in Bangladesh” (in 2015 was 93%), 85% of “Made in Mexico” (in 2015 was 90%) and 86% of products by members of CAFTA-DR (in 2012 was 98%).

the U.S.-China tariff war apparently has NOT affected China’s textile and apparel exports to the United States significantly. China’s market shares in the U.S. market also remains overall stable.

As a textile manufacturing practitioner, Chinese workers always live nearby factory they worked overtime at peak seasons, they are overall much more skilled than other less-developed countries and even the U.S. workers. Also thanks to more and more advanced technology and application of machinery, making production higher quality but faster and cheaper. These all works as an added on advantage to win the global competition.

News

CONTACT US

Name: Tim Tao

Mobile:+86-13912796617

Tel:+86-13912796617

Email:Admin@sunrisingtextile.com

Add:No.29 Nanhu Road, Zhangqiao, Xinzhuang, Changshu, Suzhou, Jiangsu, China ZIP#215000

Tim Tao

Tim Tao